TL;DR

Option assignment is not nearly as scary I thought. If you are assigned don't worry. Keep calm and remember that your position is still pretty similar. The only decision you have to make is whether you can hold the long stock.

I've been actively trading options for the past few months and passively throughout the last three years. In recent times I've been a net option seller. Meaning that overall I'm receiving credit for trades I place with the hope to let the short options expire worthless or buy back for less than I sold them for.

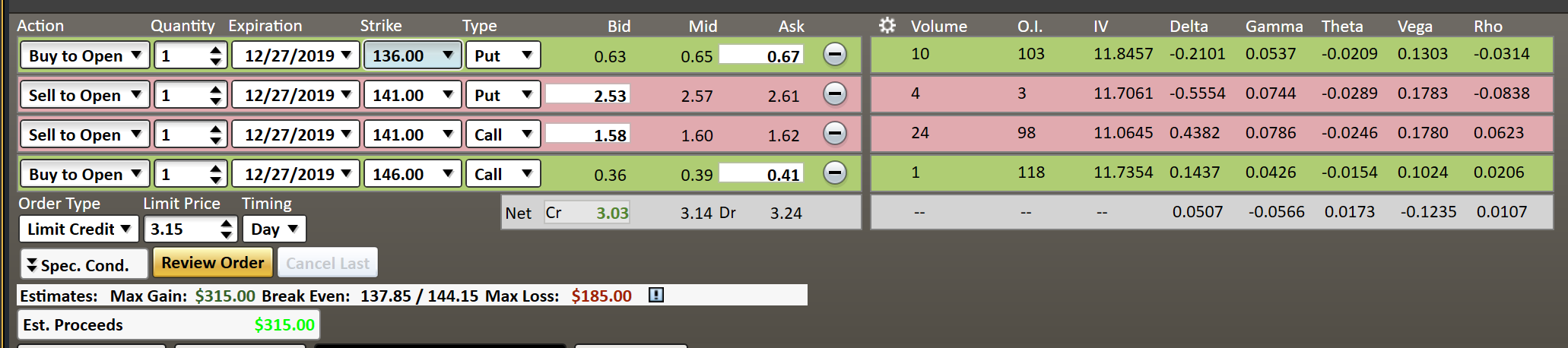

In this example I was early assigned a TLT 12/27/2019 141.00 Put on 12-19-2019. This short put option was a part of an Iron Butterfly which consisted of:

1 TLT 12/27/2019 146.00 Call

-1 TLT 12/27/2019 141.00 Call

-1 TLT 12/27/2019 141.00 Put

1 TLT 12/27/2019 136.00 Put

This position was opened for a $3.14 credit with a theoretical max risk of $500 with DTE (Days till expiration) 38. At this time the chance of profit was around 60%.

For the next two weeks the position remained fairly even. After DTE 21, IV started to decay faster and the lowest I saw the debit cost was $2.40.

TLT opened lower on the week of 12/16. Going into a dividend week (on 12/19) I definitely was thinking about the possibility of assignment risk. But usually put options are not early assigned for their dividend benefit because someone is selling their long stock at the strike price. Prior to this event I had been very concerned with assignment risk. I thought I knew how it worked but I still didn't understand the mechanics of assignment.

In the chart above you can see the gradual decline from around $139 to $136 on 12/19.

How did I know I was assigned?

On the morning of 12/19 I had this email from my broker.

I read this and tried not to freak out. I tried to remember that my theoretical max risk for this position was $500. I opened my account and looked for the assignment. Sure enough I was long 100 shares of TLT purchased for $14,100.

You can see in the account's transaction history a buy order for 100 shares of TLT at the exercised strike price.

Also in this shot is my decision to not hold the long stock. This is my small margin account and it doesn't not have the buying power to go long for this security. I sold the shares at $136.27. At the time it did not look like the price would improve. And since I was borrowing money to hold the shares I sold.

Closing out an assigned put option

The sell order was the same as if I had previously purchased the shares. The P&L for this position shows the purchase price of $14,100 and sell amount for $13,626.72 for a loss of $473.28.

The rest of the position closed like this:

146 Call expire worthless for a loss of $35.65

141 Short Call Buy to Close for $1.00 for gain of $151

141 Short Put Assigned. Kept $265 credit

136 Call Sell to Close for $35 for a loss of $35

This works out to -$473.28 + - $35.65 + $151 + $265 + -$35 = -127.93. I wasn't thrilled about the result but I knew the risks. I thought my first experience with early option assignment went pretty well.

My max loss was $500 and with factoring in the $314 credit by max loss was $186. So I lost ~$128 of that $168.

Here are my raw notes from my trading journal:

Arg this position ended up losing. TLT w/ 1 week until expiration, my short 141 Put was assigned and my account was debited 100 shares for $14,100. At the time I was able to sell back the shares for ~13,600 along with the 141 short call. I also sold the 136 long put for ~40. Overall this position ending up losing more money because of the early assignment. Roughly almost double the max lost. Overall this is the second time I've been burned on TLT! I don't want to give up because the volatility is very strong!

What if the underlying price was lower?

In a defined risk strategy like the Iron Butterfly I had in TLT the risk is well defined. Like I've mentioned the most this position could lose was $500 (theoretically).

If the price of the underlying was below $136 I would need to exercise my 136 put option. I'm not sure how this really works but theoretically this means I'd be selling the long shares at 136 taking the max loss between the assigned 141 strike and now my exercised 136. So if the underlying was trading at $130 I'd be covered because of my protective put that I could exercise.

Next Steps

Implied Volatility is still pretty good in TLT so I am still looking for ideas. I am now selling a 1/17/2020 139 Call (covered). I'm writing this post a day before expiration and TLT is down to $138 in after hours!! So fingers crossed until tomorrow's open.

Update 1/18/2020 Yesterday's first hour of trading saw TLT down to 137 and change on the open. As a result my profit order executed at a 0.04 debit. This call position saw about a $36 gain. I will wait until next week to continue running the wheel due to the holiday closures for MLK day.